Investment Philosophy

Sydinvest EM believe in the long-term convergence of emerging markets countries towards those of developing countries.

Sydinvest EM believes that emerging market debt and FX markets are generally are less liquid, less researched and less developed than other sovereign bond markets, therefore market prices generally does not reflect fair values. This implies that each emerging market country carries a unique story that often creates its own set of risk premiums (for example political risks).

Sydinvest EM believe that an active investment management approach that takes into account the fundamental factors of each country’s place in the transition cycle is far superior to passive benchmark driven strategies. We believe that this requires an idea generation process, which is based on deeper research and long-term experience with the underlying risk and return drivers.

Sydinvest EM’s investment approach is to run an active investment process that can create attractive risk-adjusted absolute and relative returns far exceeding those offered investors in developed bond markets. Our idea generation springs from a combination of sources, one for example being the sovereign ESG screening, another from the fundamental country screening process “COSMO” and lastly the ongoing risk and return feedback from existing strategies that develop through time.

The research combine a top-down and bottom-up approach that takes a key focus on relative valuation across countries, assets and currencies to arrive at a final opportunity set for each asset class. This involves a tight attention to risk management throughout the process from the initial global risk allocation down to the specific sizing of the final position. Ultimately, the process ends with an allocation of a set of Model Portfolios for each strategy.

Sydinvest EM offers investors this dedicated process through its decade-long experience of investing into both mature as well as Frontier hard and local currency emerging markets. Sydinvest EM’s process is built upon a business philosophy of lean efficiency, where a small opportunistic team always will be able to express and opportunistically execute the unique investment style to the benefit of investors.

Sydinvest EM is fit for this purpose.

Sydinvest EM Business Philosophy

- Danish Heritage

Denmark is one of the World’s 10 remaining S&P AAA rated countries with stable outlook.

Sydinvest EM is an institutional UCITS fund offering managed by Sydbank A/S. Denmark’s 4th largest bank.

Sydinvest EM is operated by Syd Fund Management from Aabenraa in Southern Denmark and we our business upon the core values of strong investment skills, close client relations and long-term partnership values.

- Independent & Focused

Sydbank Asset Management (SAM) is the dedicated investment advisor to Sydinvest EM.

Our investment strategies are offered across a number of EM debt asset classes and in blended products.

We employ highly skilled and experienced portfolio teams who operate with high degrees of autonomy to invest.

We ensure focus are kept upon investments and leverage off the Sydbank Group Services to ensure ongoing mandate compliance, flexible execution platforms and top-tier client services.

- Fit for Purpose

Sydinvest EM believe in lean organizational resources and structures to fit each task purpose. Our teams are equipped with sophisticated proprietary systems as well as third party operational services engines to ensure a high degree of automated processes and efficient client reporting.

- Client Focused

Our Clients are our partners. We build strong relationships that last for the long term. Our ambition is to deliver high quality in returns. In addition, we offer top-tier services and flexibility in research, reporting as well as full data transparency for insurance and pensions investors.

- Highly Competitive

Sydinvest EM offer investment in EM Debt at very competitive prices relative to peers. We strongly believe that true quality can come at reasonable prices and that we serve our client’s interests best through long term relationships rather than going for short term revenue gains.

The investment process for Sydinvest Emerging Markets

The Sydbank EM Debt Team conducts the investment process from a common mindset anchored in the Team’s investment philosophy that spans across the hard and local as well as blended debt strategies.

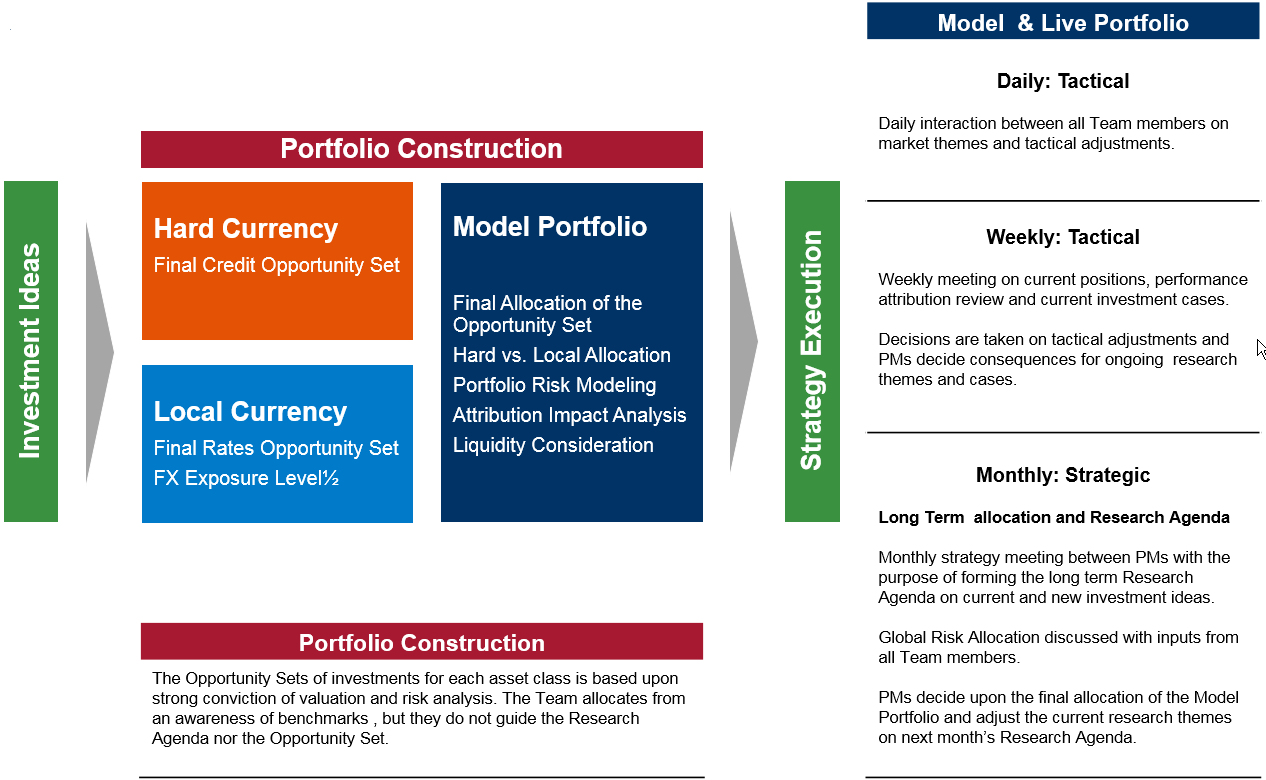

The investment process is structured in two parts; first a Country Research phase that forms the opportunity set of investment ideas; and second, a Portfolio Construction phase where the allocations are set towards risk and return targets.

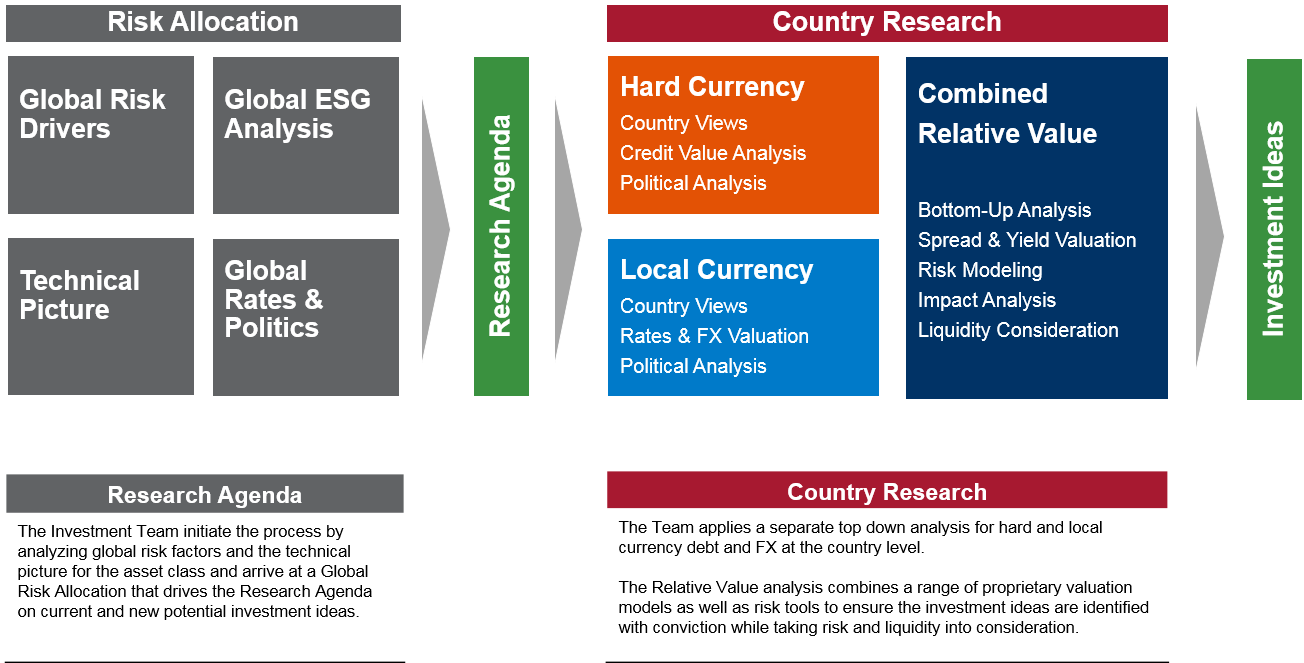

The Investment Team initiate the process by setting a Research Agenda that drives the core part of the Country Research. To kick off the process, they start by analyzing global risk factors such as G3 economic indicators, hiking cycle of global central banks, geopolitics, commodity prices and the technical picture for the asset class. In addition, they include the global ESG screening and exclusion of EM countries to ensure the research is conducted within the “investable universe” while still observing ESG trends in the universe of countries close to the exclusion level. ESG excluded benchmark and/or off-benchmark countries are included into the risk analysis as the team will discuss alternative investment candidates and their target risk properties to be included into the Research Agenda. The global risk allocation sets the bar for the target level of total risk in the final portfolio construction and therefore governs the priority of the Country Research.

Overview of the Investment Process

Investment Research Process

The Team will work with each investment case towards a final Model Portfolio in a way that takes into account the evidence derived through the initial research as well as the subjective and experience passed views of all senior portfolio managers. In addition to the discussion on the individual positions, the investment managers will evaluate the attractiveness of each asset class to determine the blended allocation most suitable for the return and risk target set for the strategy.

Portfolio Construction

Execution Policy

Object

Best execution

To obtain the best possible results for the funds managed when executing trade orders (best execution) Syd Fund Management A/S takes into account factors that affect the total consideration, representing the price of the financial instrument and all expenses directly related to order execution.

Execution Policy (PDF)

About Sydinvest Emerging Markets

Sydinvest Emerging Markets is a UCITS fund product dedicated to institutional investors seeking direct and efficient exposure to sovereign debt and FX from emerging market countries. The Funds are structured as institutional share classes of the Danish investment fund Sydinvest. Share classes are offered in EUR or alternative currencies depending upon investor demand.