ESG Investments

Sydinvest EM place significant importance to the inclusion of Environmental, Social and Governance factors into the investment management of the Funds. Sydinvest and Sydbank A/S has since 2010 been signatories to the UN principles for responsible investments PRI.

Sydinvest EM is strongly committed to develop and promote its ESG research and active management approach into sovereign emerging market bonds.

Sovereign Bonds ESG Screening

Sydinvest EM use Sydbank as advisor to the sovereign bond ESG screening and its integration into the active investment management of the Funds.

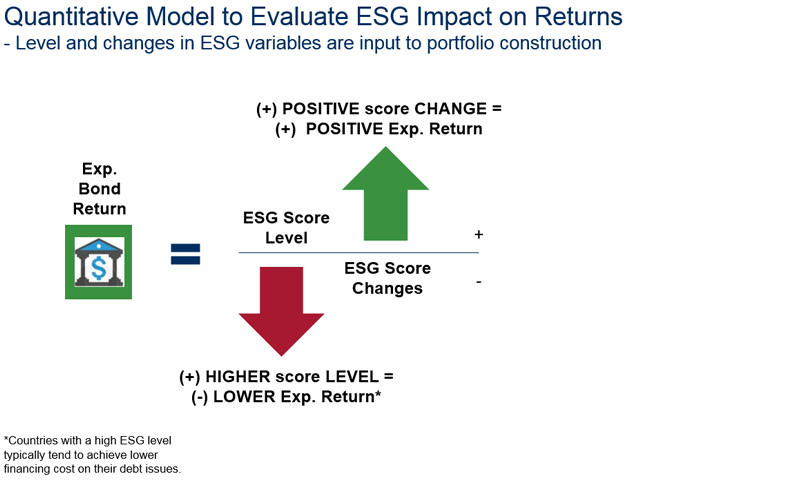

Sydbank integrates ESG in the investment process firstly to understand how countries develop and what risks that must be attached to their political, institutional, social and environmental state and progress. Changes in the ESG factors are key drivers to long-term investment performance. Therefore, the research process must include an evaluation of both the level as well as the potential for improvement or decline in ESG factors.

Secondly, in ESG analysis it is important to ensure we have a solid and consistent framework to screen and implement internationally recognised norms that allows us to apply a set of clear and unambiguous criteria with meaningful thresholds. This enables us to select the poor performing ESG country from the better performing ESG country.

Our investment philosophy entails a deep understanding of the underlying fundamentals with regard to the development of emerging economies. ESG is not only a question of setting an absolute level and define it as sustainable. Sometimes it is also about the path to prosperity, and sometimes it is about taking a normative view on whether to invest or not.

Therefore, the question of sustainability comes in many forms and shapes.

ESG Core Screening Methodology

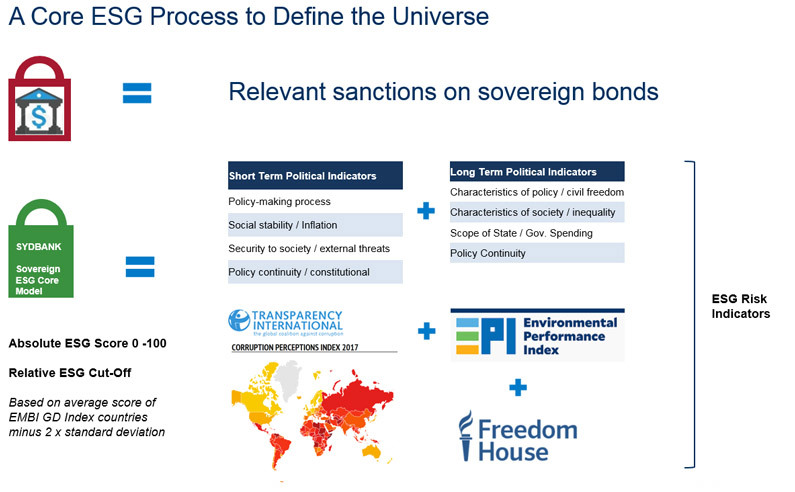

Sydbank has developed an ESG approach, which is a multi-stage ESG research process, which is applied across all Sydinvest sovereign bond funds. We call this the ESG Core approach.

This framework serves two important roles. Firstly, it screens out the minimum lower threshold for a country’s sustainable ESG score. Secondly, it provides valuable information to the portfolio construction process as it enable the portfolio managers to analyse ESG risk premiums and ESG score developments.

The ESG Core factor model use data on a country’s short term social and long term political risk as well as well-known indices on corruption from Transparency International, political freedom analysis from Freedom House and environmental performance from Yale University.

It creates an absolute score from 0 to 100 (with 100 being the best) and use a relative measure based on the JP Morgan EMBI Global Diversified Index to define the lower threshold for inclusion into the investment universe.

In the portfolio construction phase, Sydbank integrate the ESG factors by taking into account the fact that countries with a positive change in the level of ESG usually faces lower debt financing costs over time and therefor ESG is often is rewarded by markets with lower bond yields, thus giving a positive bond return.

The ESG+ Process and the Investment Process integration

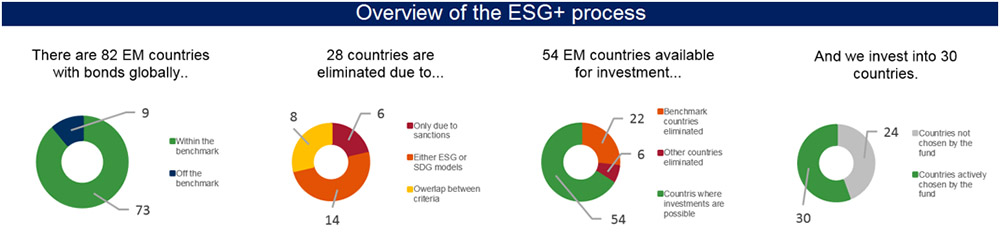

Sydinvest’s ESG+ process for sovereign EM bonds is the most extensive ESG analysis offered for our funds. It includes more ESG data and tougher criteria compared to a traditional risk-based ESG analysis.

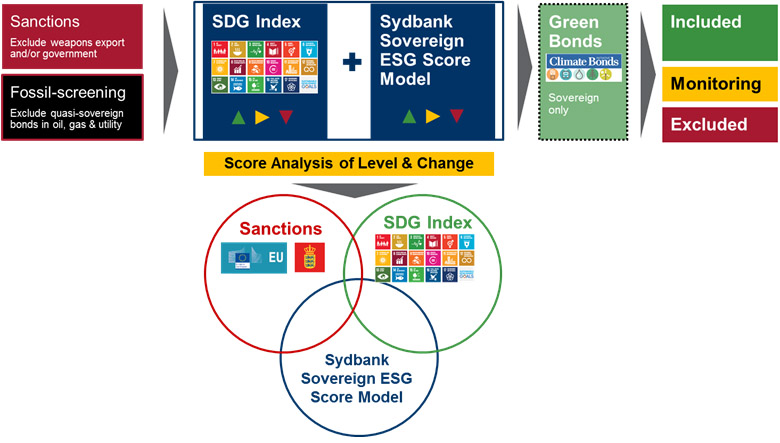

While the ESG+ use the same underlying methodology approach as that of the ESG Core there are important differences. The ESG+ approach includes a global index that tracks countries implementation of the UN Sustainable Development Goals for 2030, it explicitly excludes countries subject to weapons sanctions and it excludes quasi-sovereign companies involved in fossil fuels business areas. Finally, it aims to include green sovereign bonds where such opportunities emerge.

Illustrative example only.

The global EM sovereign opportunity set is analysed using with the different ESG models and screening for normative criteria such as sanctions. The principle is simple: Each country must pass through all three evaluations; no relevant sanctions, sufficient level and progress on the Sustainable Development Goals Index (SDG Index) and similar conclusion on Sydbank’s proprietary ESG model.

The three connected circles illustrates the full ESG+ process that may lead to an exclusion of a country. Together the steps represent the lower red box to the right in the traffic light categorisation. As the illustration shows, the sanctions analysis is the first “red line” all must cross to be relevant for the data-driven ESG analysis.

Sydbank use the countries belonging to the JP Morgan EMBI Global Diversified Index (EMBI GD) as peer group. The 2019 version of the index consist of 73 emerging market countries. They have very heterogeneous characteristics in terms of macro economical and political factors, but together they form a strong representation of low and middle income developing countries who issue sovereign bonds.

Sydbank use the EMBI GD Index to calculate relevant ESG score thresholds for quantitative screening metrics based on mean and standard deviations. This approach is used consistently on both Sydbank’s proprietary ESG model and when analyzing the Sustainable Development Goals Index.

The yellow countries – the “monitoring” box – is the category of countries where the analysis of level and progress is most important. It is the dynamic part of the research process for two important reasons:

- Ensure that investments can be made in less economically and politically developed yet relatively good ESG performing countries. This is where the investments has most impact both from a financial as well as non-financial perspective.

- Ensure to make an early capture and potentially avoid the “seemingly good” countries that turns towards a negative ESG performance path. When a country stabilise its negative trajectory, it is equally important to make a re-evaluation of the ESG situation that may lead to new investments.

Since ESG research is conducted on all countries it follows implicitly that the conclusions are brought directly into the portfolio construction process. The portfolio managers will make active decisions on both sides: Given some countries are excluded there are alternative opportunities where the combination of ESG factors and traditional investment valuation factors are equally or even more attractive.

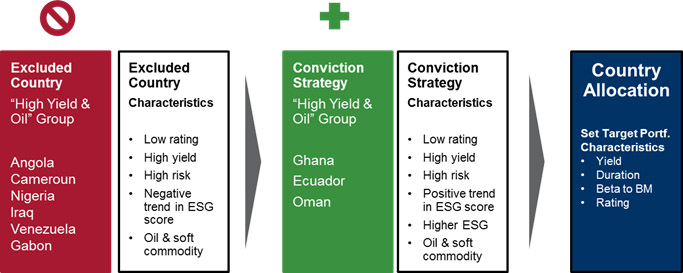

The illustration below completes the ESG+ process by showing how the portfolio construction works towards the final ESG integration and investment decision taking.

ESG Portfolio Construction: Target similar expected risk and return as “non-ESG” portfolio

Illustrative example only